Copernicus is a web native full lifecycle asset finance system with pricing, , , , , contract management, , and end of term processing. Copernicus has its own highly flexible financial which generates pricing, income recognition, rescheduling, partial and full settlement and calculations. These calculated values feed into the inbuilt real-time double entry bookkeeping system which is at the heart of Copernicus’s financial control system.

The standard financial products in Copernicus are Hire Purchase (conditional sale in the USA), finance leases, loans, operating leases, project finance and block funding. These are highly configurable and new products based on these basic types may be created by users. Furthermore, the use of “schemes” enables constraints to be laid on top of the standard product features. For example, default values for Yield required or document or other fees. Copernicus has optional project finance and construction period options enabling the build out of an asset before it becomes a lease at “term out”. Interest may be charged during this period or rolled up to the lease start date. Contracts may be fixed or variable rate and optional services such as maintenance or insurance may be included in any of the products

Copernicus has been used in the UK, Europe, USA, China and Africa

User defined language and terminology

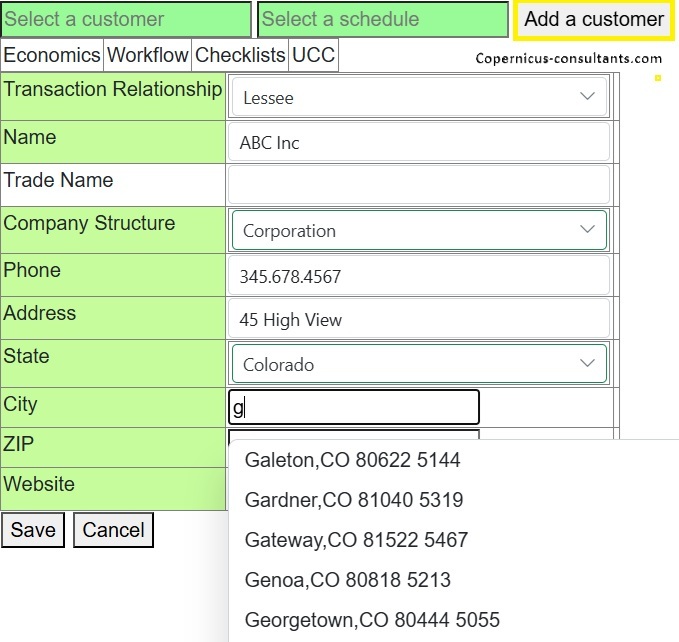

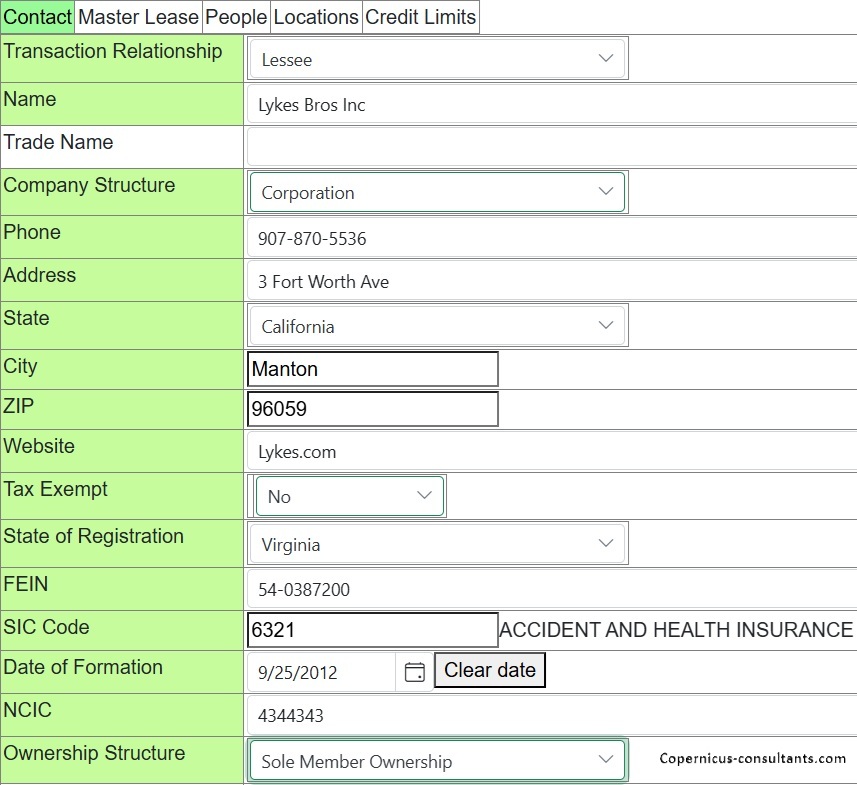

Loading a new proposal is very easy. Click on “Add a customer” and you can enter basic information. Further information about the lessee is gathered later if and when the proposal progresses. As well as the standard contact data you can define your own requirements

Single source code with all local and financial product options data driven

Multi-currency and ability to report in any nominated currency

Copernicus is written using Blazor which is Microsoft's key business software product and will be supported indefinitely. Copernicus is entirely Microsoft using .NET 9 (plus) and SQL Server 2019 (plus) database technology

Copernicus can provide customer, vendor and broker portals which enable third party access for authorized users. This gives them limited visbility of data and the ability to make a controlled number of enquiries and update data on a controlled basis

Copernicus uses Microsoft's latest security technology. There is no JQuery or other vulnerable technology

Available as either a hosted solution or, for larger clients, as an in-house system

Even with thousands of contracts Copernicus has very fast response times

See top 10 arrears, current status of proposals, new business, priority actions and more on a single screen

Messages are actions and notes within Copernicus and are a single, centralized approach to making diary entries for individual users or groups of users. These actions may be repeated, for example, to ensure that annual insurance is maintained (see Regular reminders).

Repeated actions - for example, quarterly inspections or annual services – automatically diarized

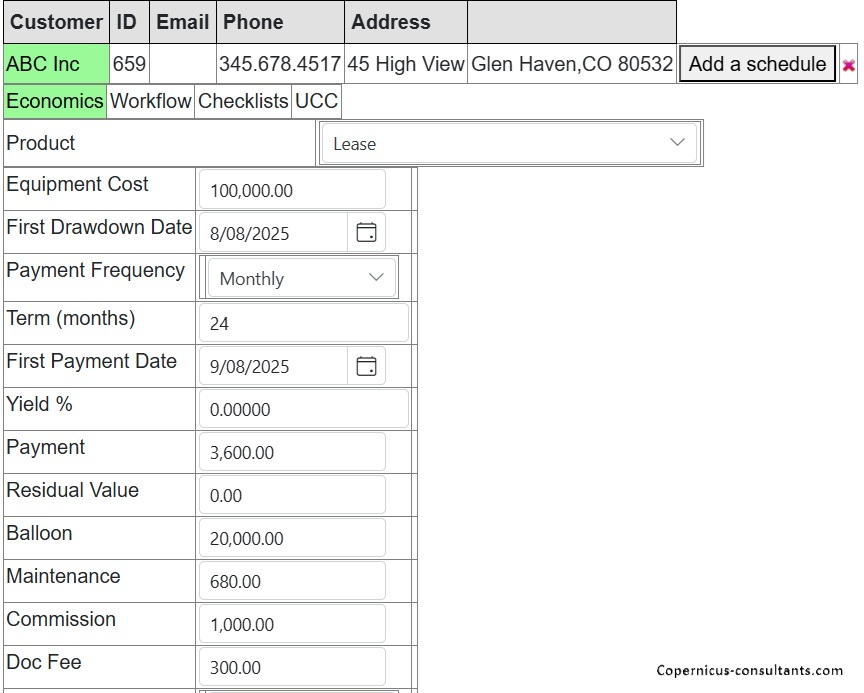

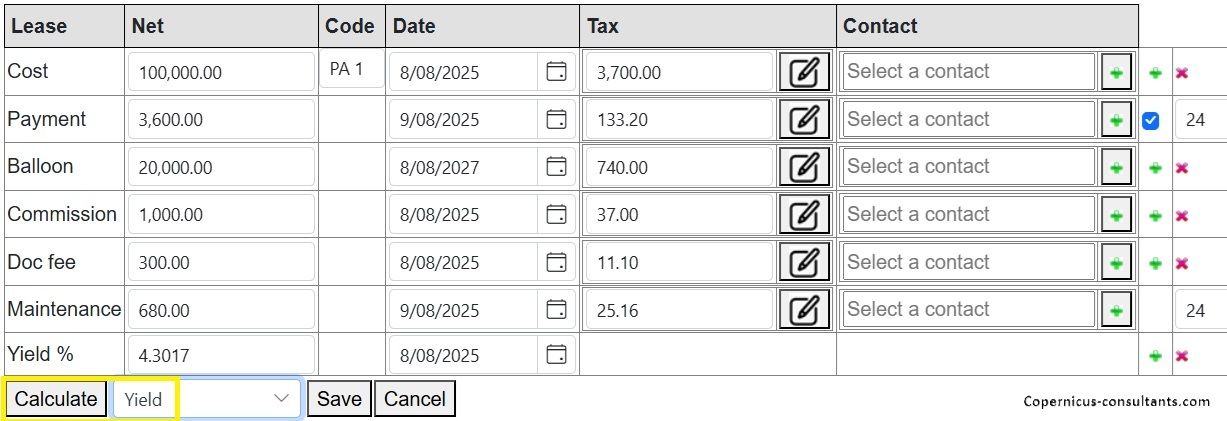

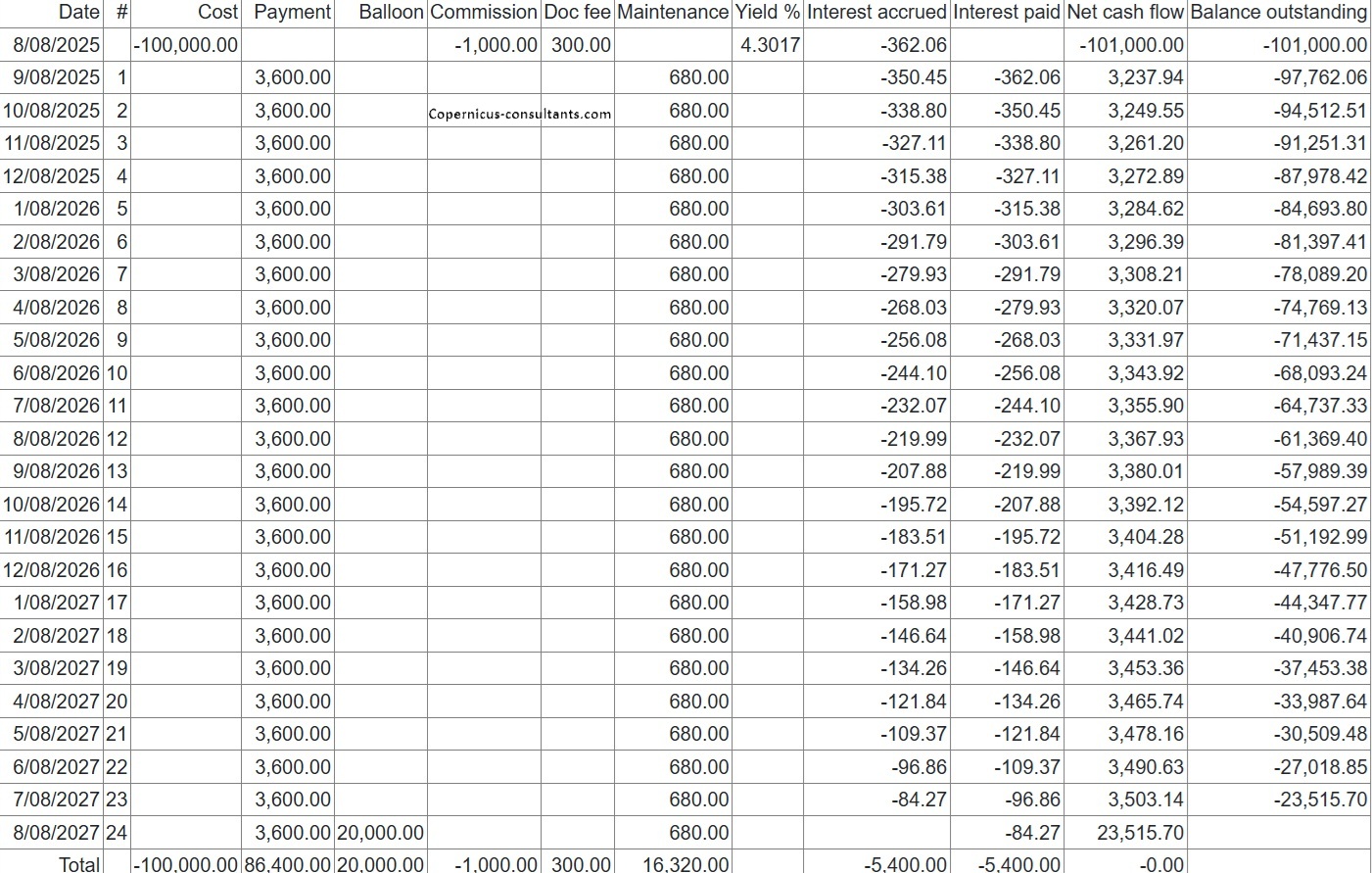

Copernicus has an inbuilt calculator to calculate any structure of drawdowns and repayments. The calculation engine is compatible with TValue™ and other pricing engines. It is totally parameter driven. For example, interest may be calculated based on 365 or 360 days per year or interest might be based on equal monthly periods. We believe there is no structure that Copernicus cannot handle. See the Calculator tab for a simple example.

A calendar view of actions is available to see upcoming diarized items

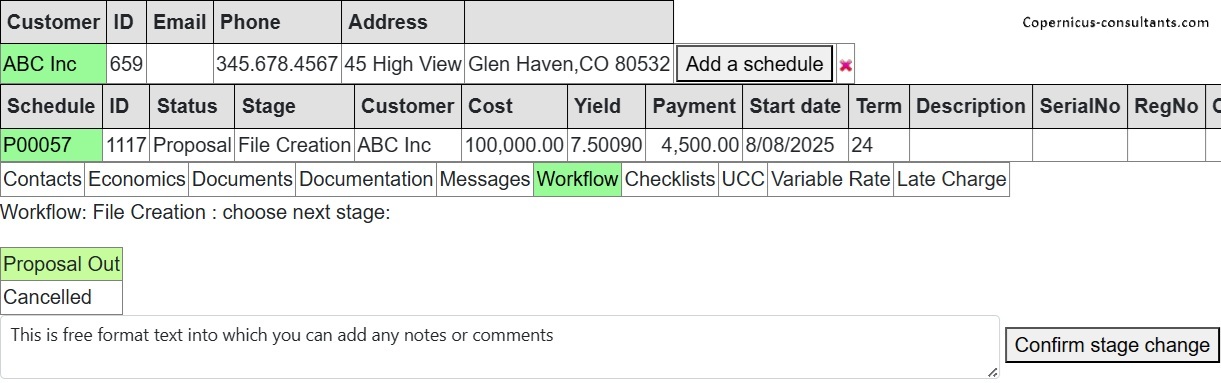

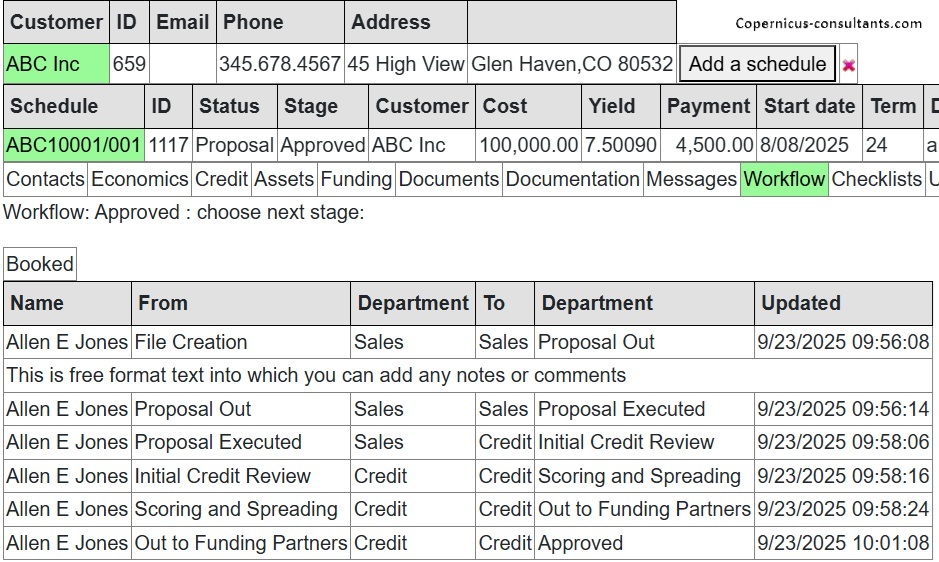

Fully user defined by process (proposals, collections, repairs and so on). Workflow can have multiple routes depending on, for example, amount financed or type of business. Routes can be repeated until completed or cancelled. There is a full audit trail of user and timestamp and comments made as a proposal moves through the workflow.

All document templates may be edited and pre-viewed online within Copernicus by authorized users. Documents are generated automatically using a 'mail merge' approach as a proposal moves into a contract and beyond. There are sophisticated signature block facilities to ensure that only authorised users may sign certain types of document

Email and text alerts as a proposal moves through the various stages of the workflow

Collections workflow fully integrated with arrears reporting

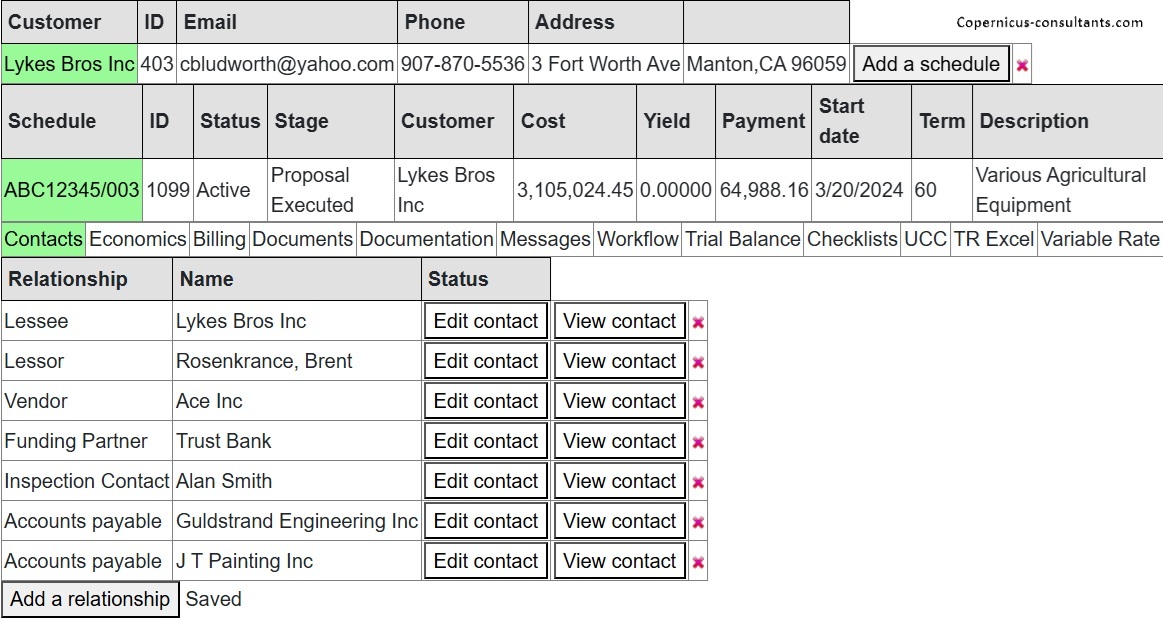

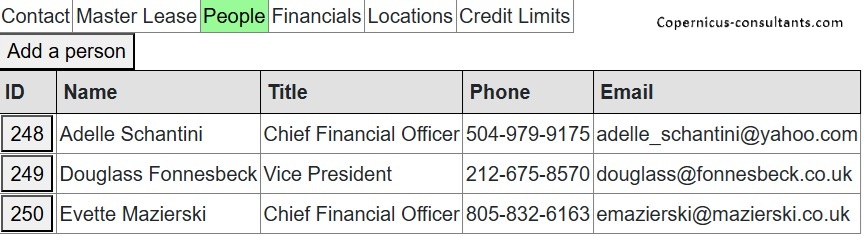

Sophisticated CRM contacts database (customers, suppliers, brokers, funders etc). Companies and individuals are “contacts” and may have different roles in different proposals and contracts. Here is an example of a list of contacts for a contract

Total view of business including exposure by to a contact irrespective of the role he has in each contract

Moodys, S&P, NACE and other classifications

Each customer may (optionally) have one or more master leases. Each schedule then sits under a master lease and abides by the general terms of the ML. Schedules are coded, for example, ABC12345/001, /002 etc

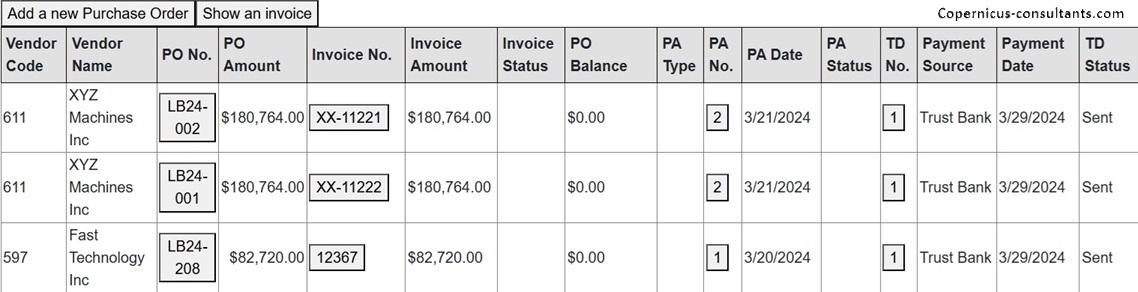

Copernicus enables Purchase Orders to be managed and matched to Invoices Received. When and invoice is approved to pay then progress interest starts and the customer receives his first progress interest invoice. When funded (which might be a different date) the funder starts being paid. Here is an example of how this looks in Copernicus

Copernicus contacts may be integrated into other CRM systems such as SalesForce with specified master and slave relationships

Any payment structure may be used for proposals. This can be controlled/restricted using “Schemes” for each financial product to ensure that users stay within their authorized limits and for setting default values and permitted ranges for items such as yield and fees

Sophisticated user-defined decisioning and credit scoring facilities which can be used, for example, to ensure that certain criteria have been achieved before allowing a stage change in the workflow

Transfer to contract on fulfilment of user defined conditions

Credit limits may be maintained by contact (customer, supplier and so on) and by financial product

Integration with CRAs (subject to users having an account with the CRA)

Unlimited number of contracts each with any number of assets. Assets can be transferred from one contract to another and also into stock for refurbishment before sale or onward lease

Each contract is attached to a customer (and other contacts such as supplier, broker etc), company, division and branch (optional)

Payment profiles can have any pattern (stepped, seasonal etc)

Any number of drawdowns on any dates

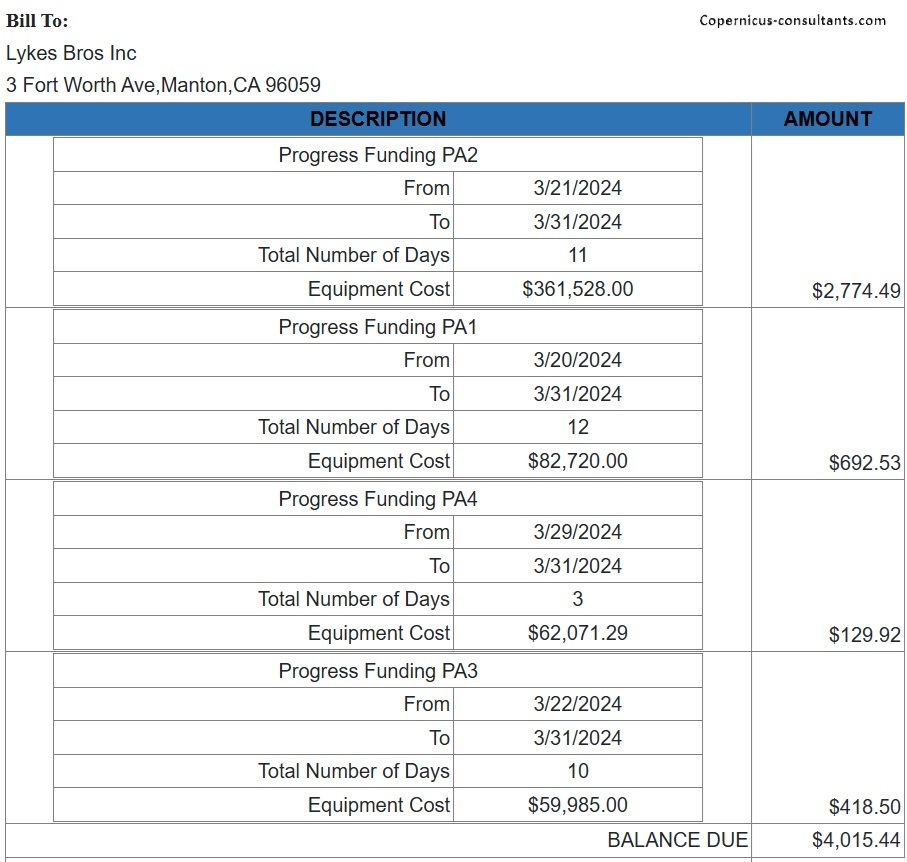

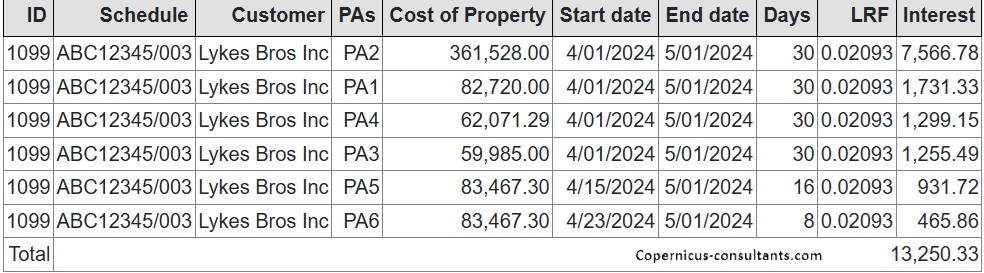

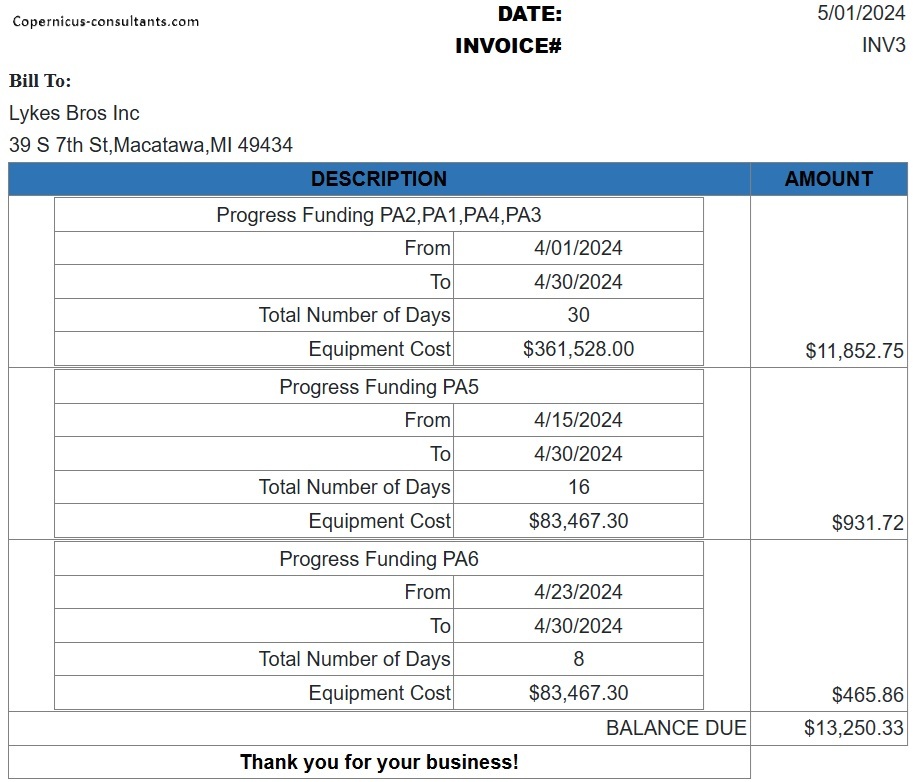

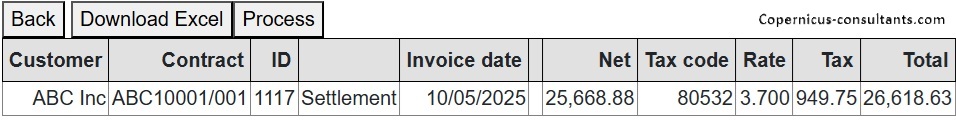

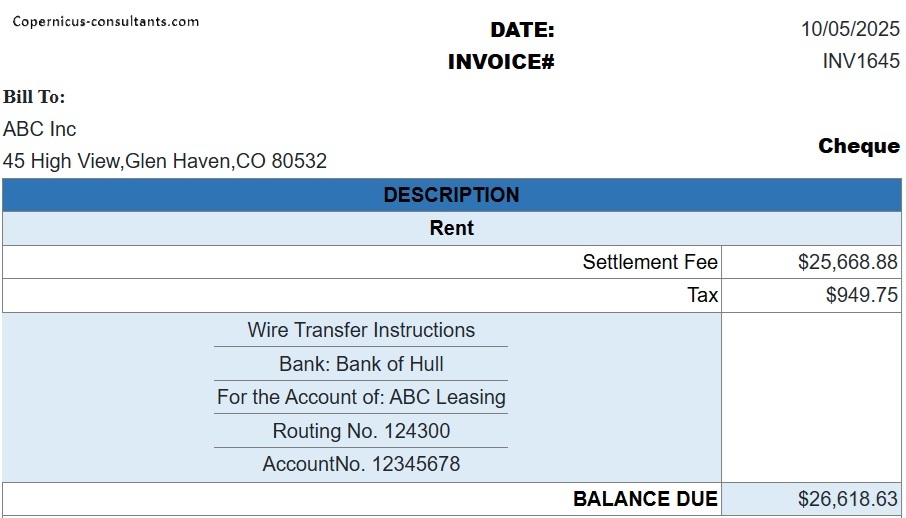

Interest progress payments are calculated automatically based on Lease Rate Factors (LRF) or a yield during a build out period. For example, the lessee progress payments might be calculated using a LRF whereas paymnents to funders are most likely to be based on a yield %. Here is an example of a lessee progress interest invoice

An interim rent to place the full payment on the first of the month is calculated automatically

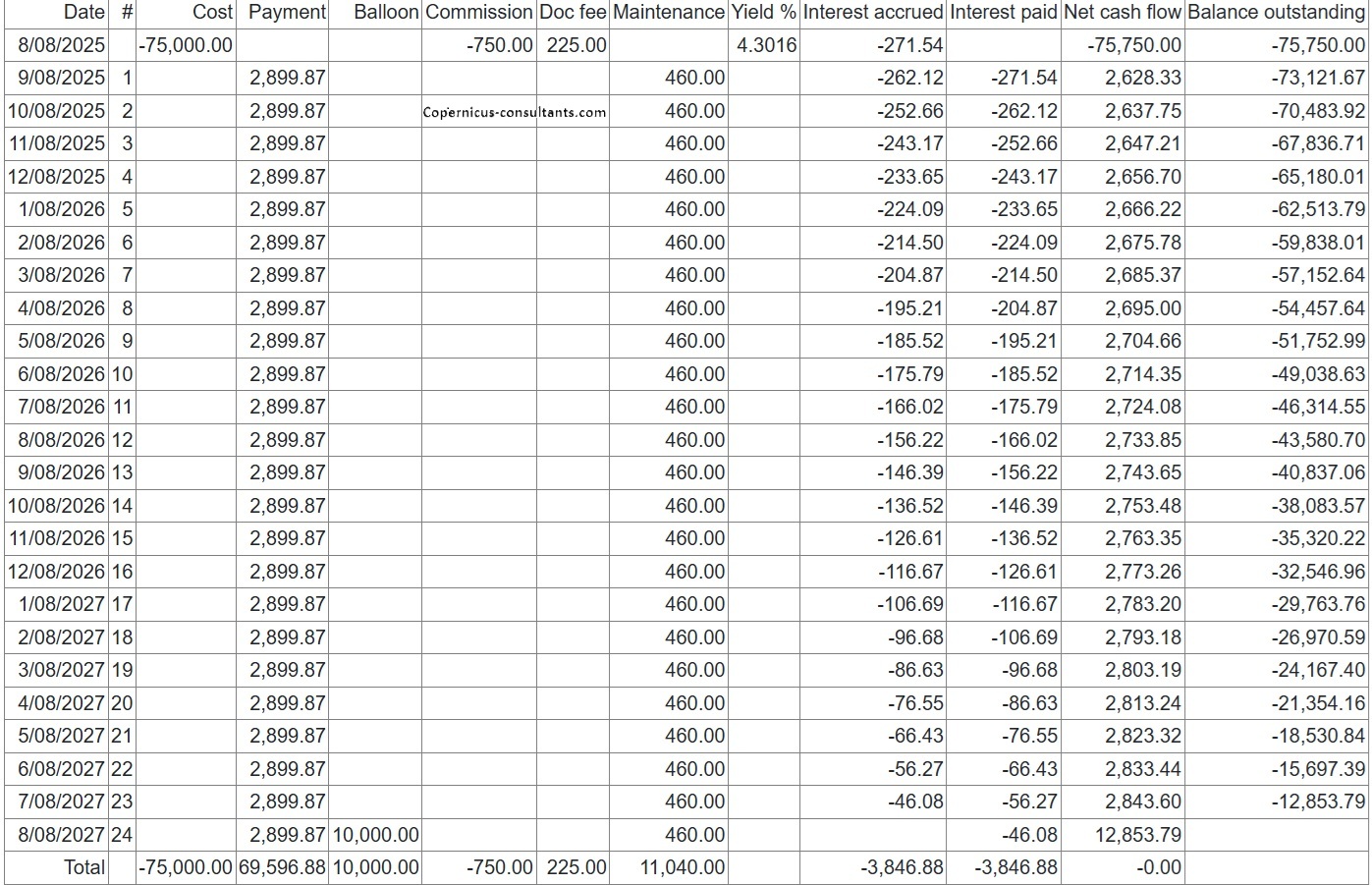

Can include other cash flows including deposits, balloons, commissions, residual values, maintenance and insurance

Secondary period rentals are auto generated as they are invoiced to enable a perpetual rental until cancelled

Audit trail of all cash flow changes and automatic adjustment of Balance Sheet and run-off following rescheduling

Automatic alerts can be configured and raised when sensitive data is changed

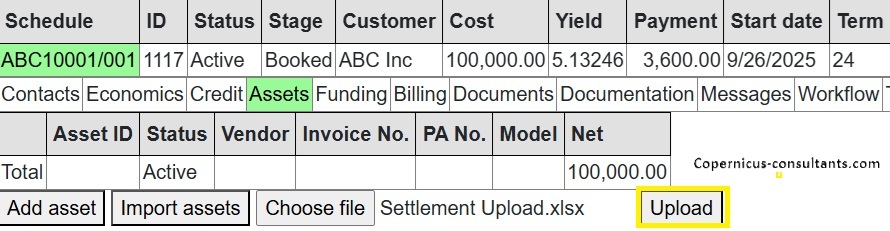

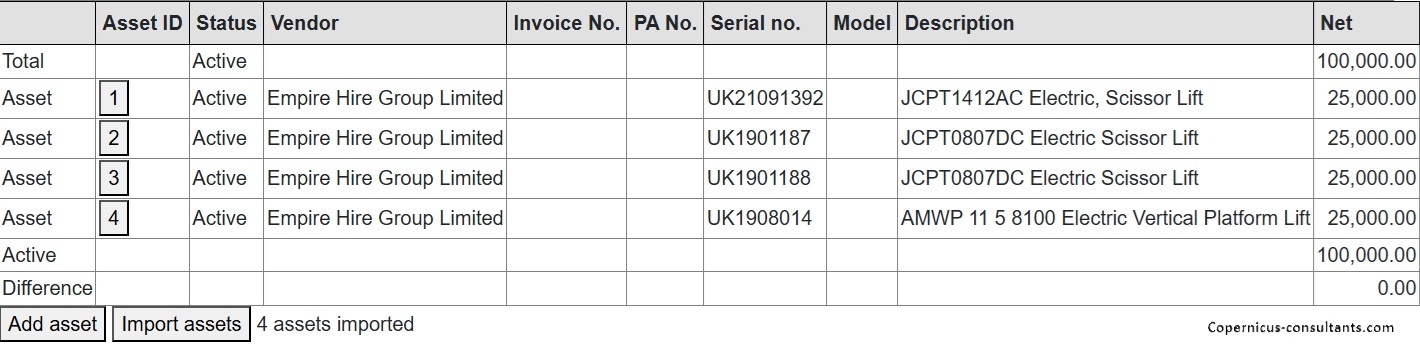

Assets can be uploaded/imported from Excel. Assets need to be itemised in this way if they are to be processed in partial settlements. To upload an Excel spreadheet of assets click the Assets tab, select a file on your local disk and then click Upload

Value curves attach to assets (and asset types) enabling a net book value (calculated by Copernicus) versus forecast value and the difference to be reported

Copernicus enables multiple depreciation “contexts” to be maintained per asset, for example, UK capital allowances or book depreciation. USA Federal and State tax depreciation

VAT and sales tax set during the invoicing process to ensure latest rates are used (especially important for sales tax which changes fairly regularly)

Interface to Avalara, Vertex and other sales tax rate providers to retrieve latest rates at point of billing (subject to users having an account with Avalara, Vertex or other provider)

Copernicus stores inbound scanned documents and outbound generated documents such as invoices in a separate database ensuring that an exact replica may be regenerated as required

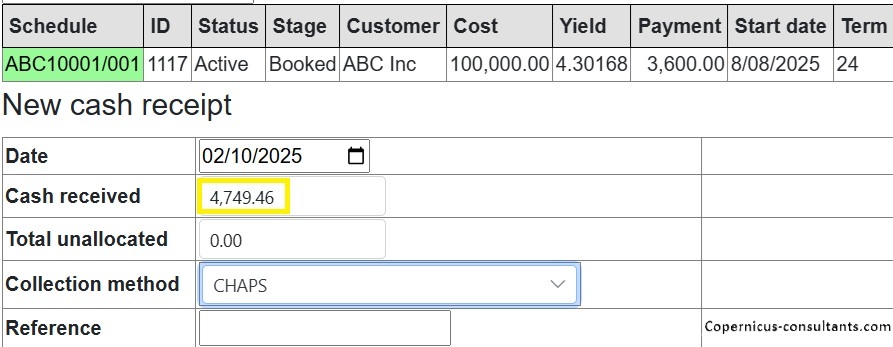

Cash receipts can be full or partial with automated split of principal and interest if required. A full cash allocation (and deallocation) history is maintained. Cash can be collected by credit card. Use the Administration / Receipts / Cash/credit menu option. Copernicus displays any outstanding invoices

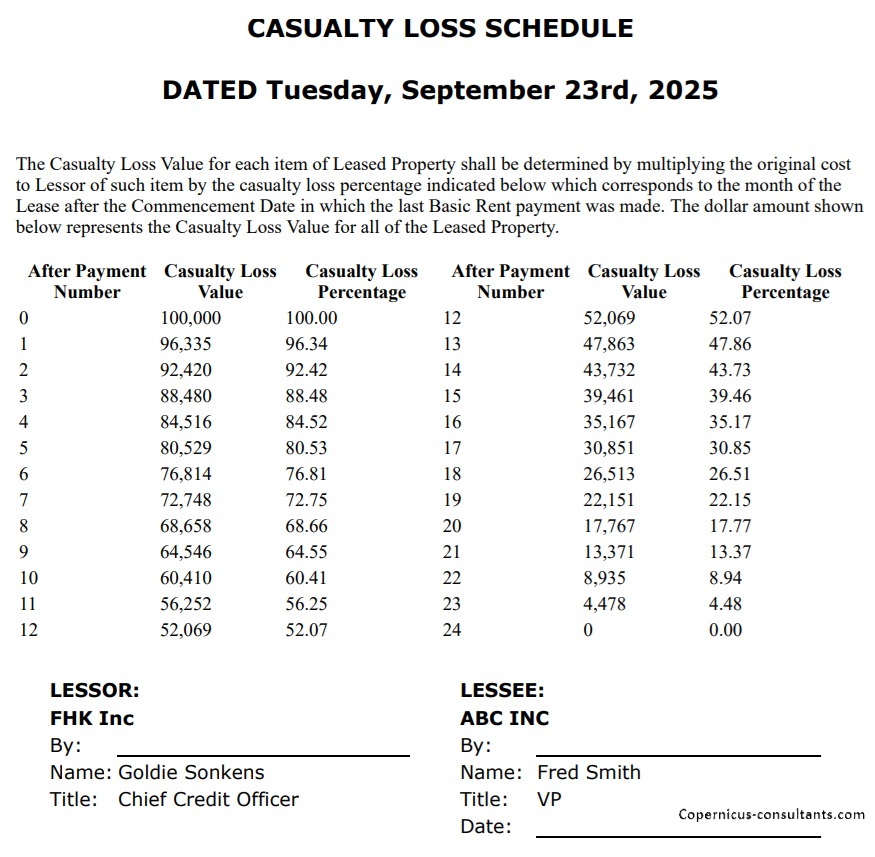

A Casualty Loss Schedule may be generated automatically as a PDF document with automated signature blocks (see Documents), for example

Direct debit (BACS and ACH) registration, collections, failures and resubmissions. Manual direct debits.

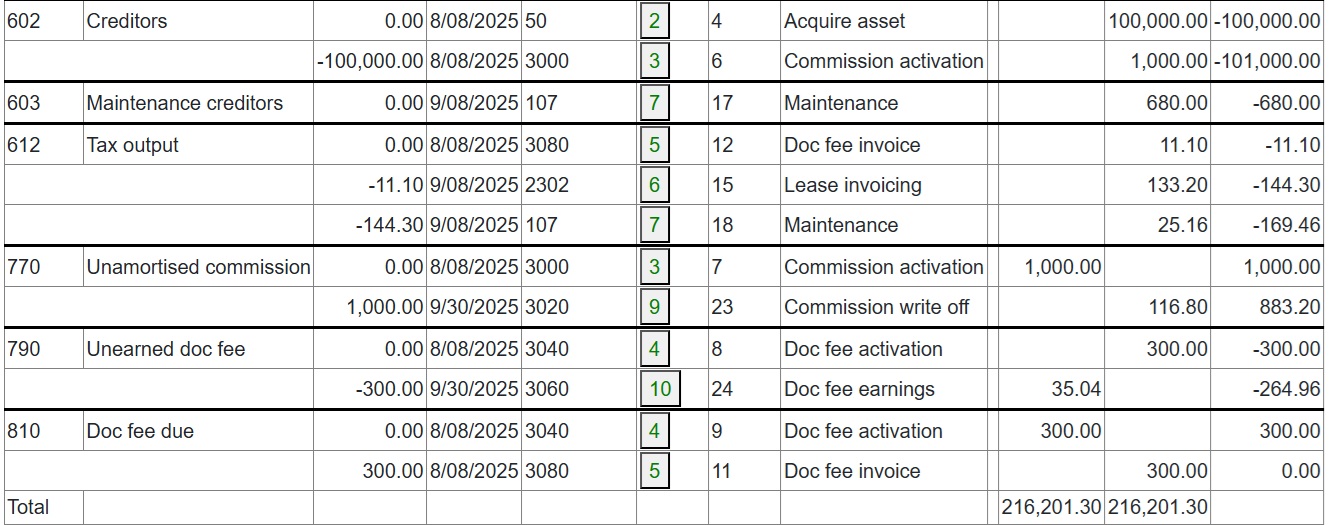

Copernicus includes optional “4 eyes” authorization

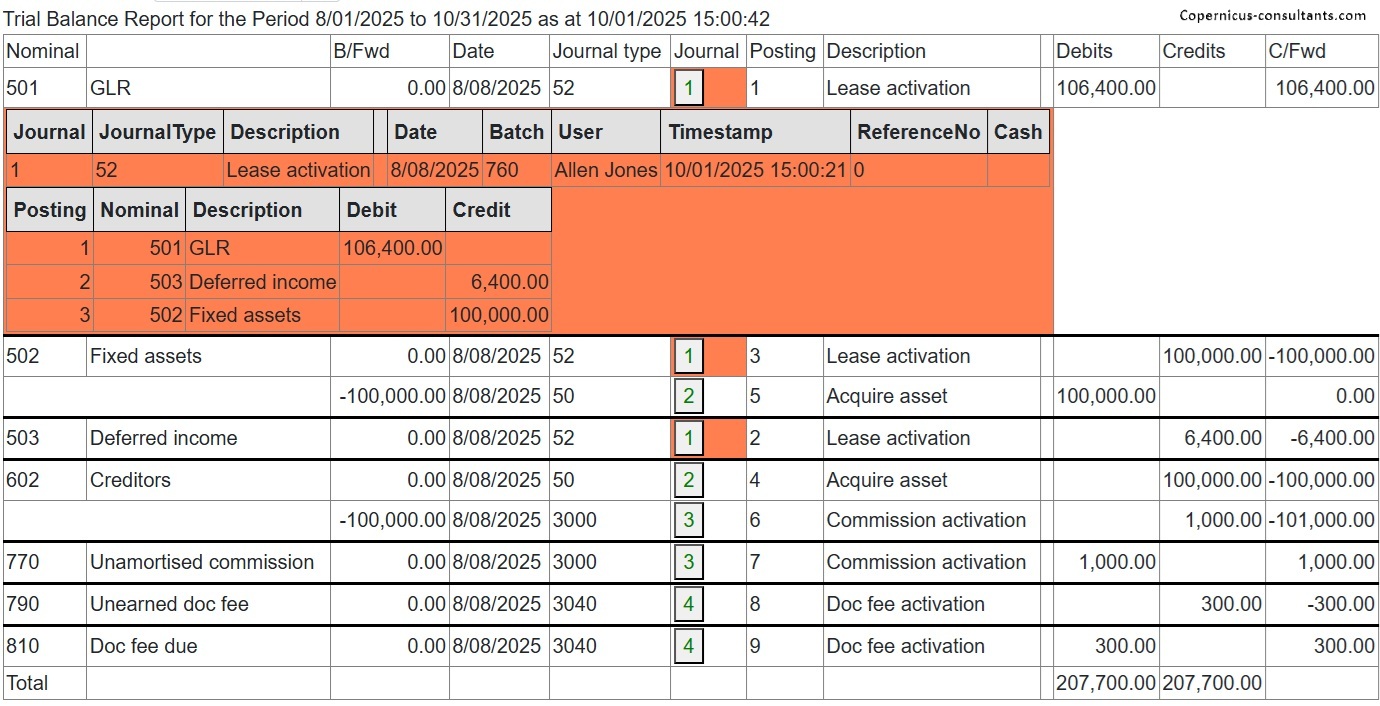

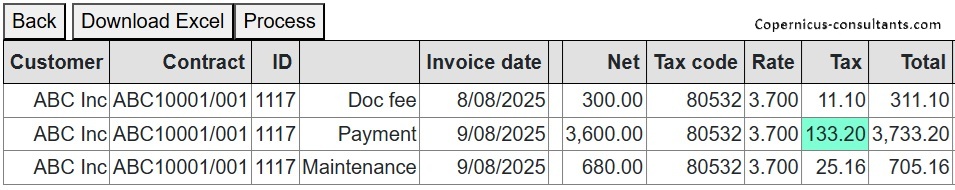

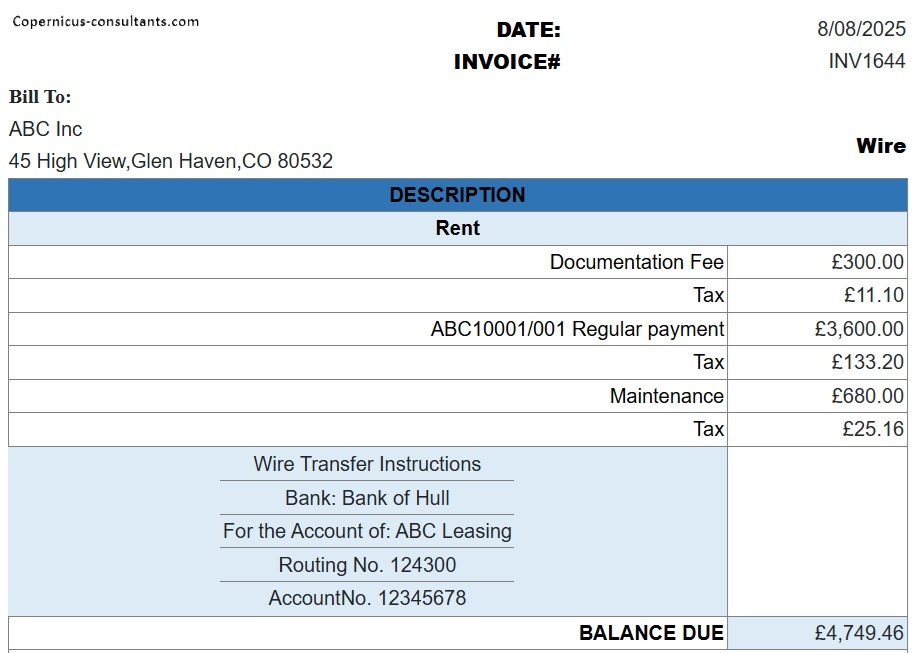

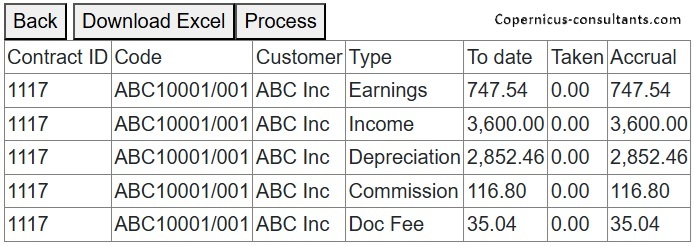

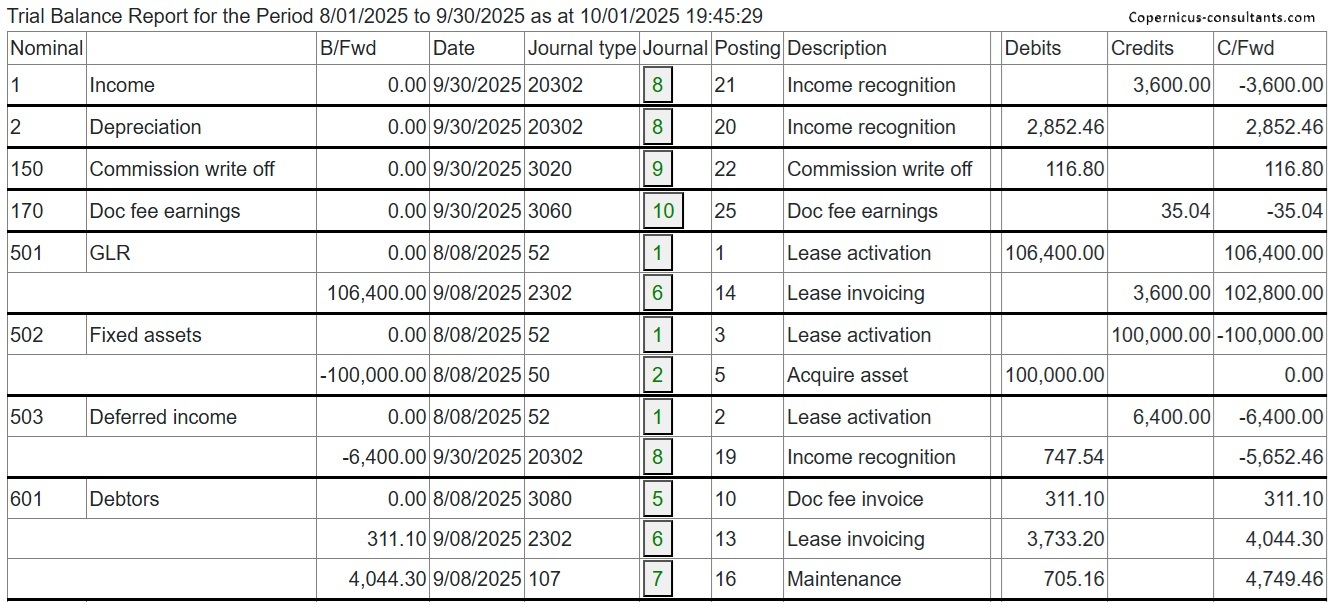

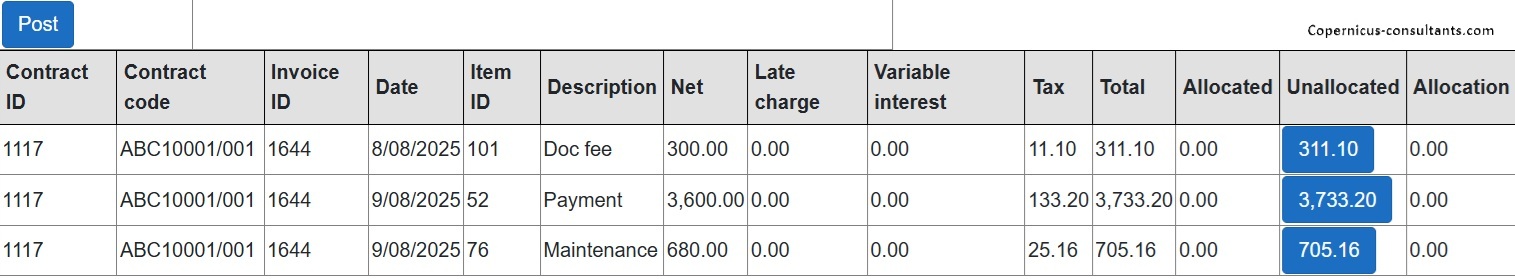

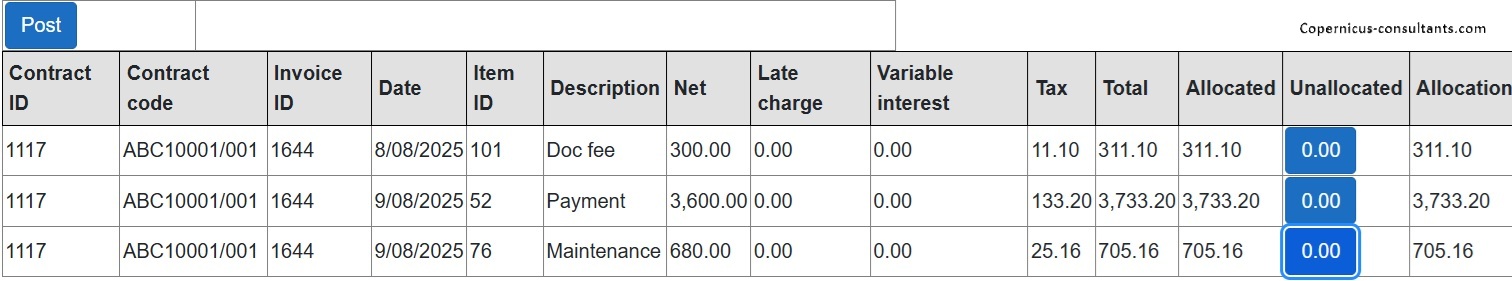

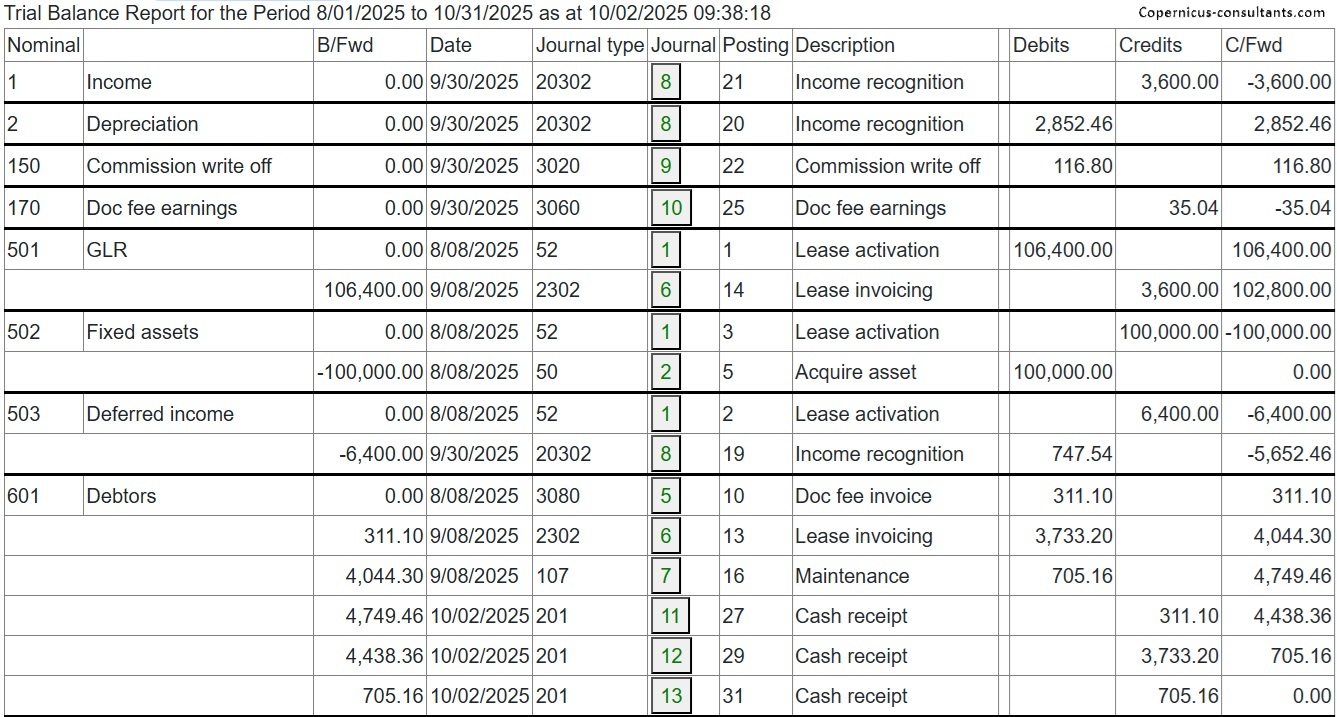

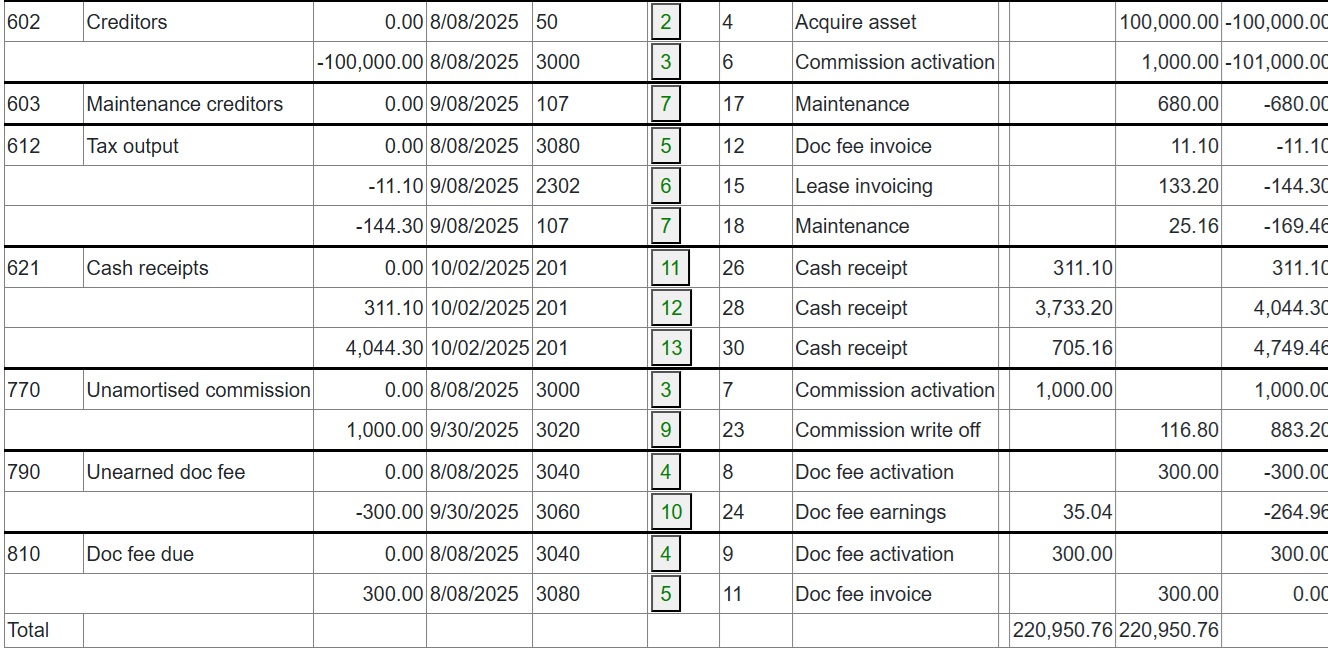

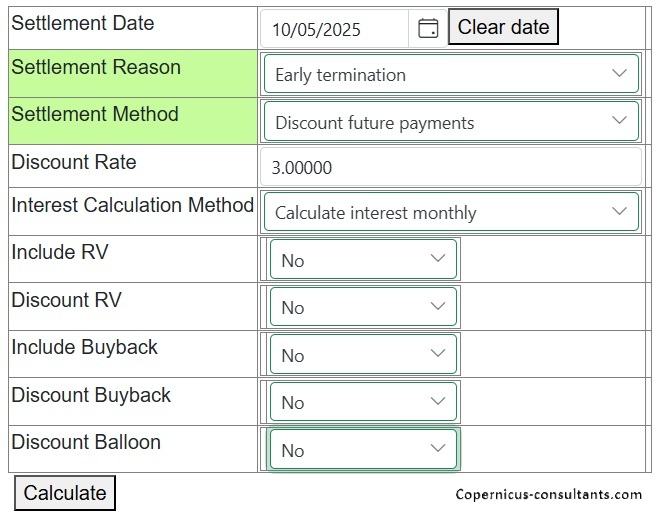

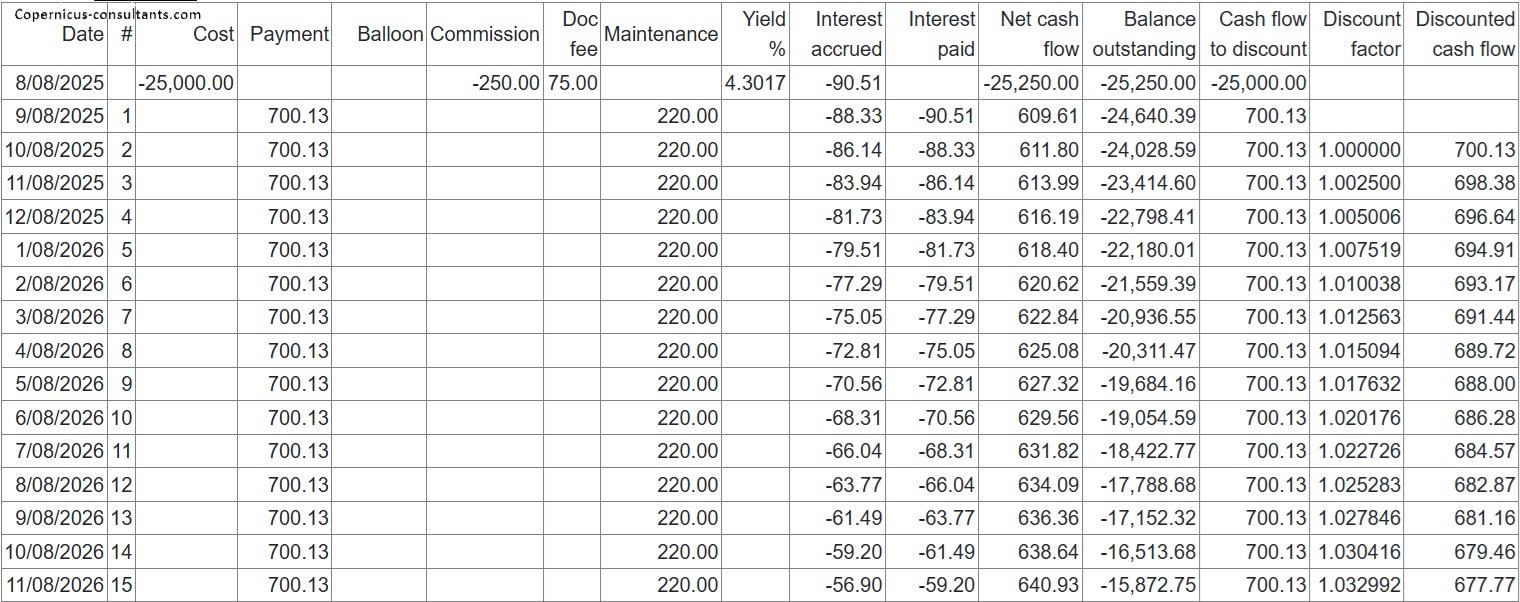

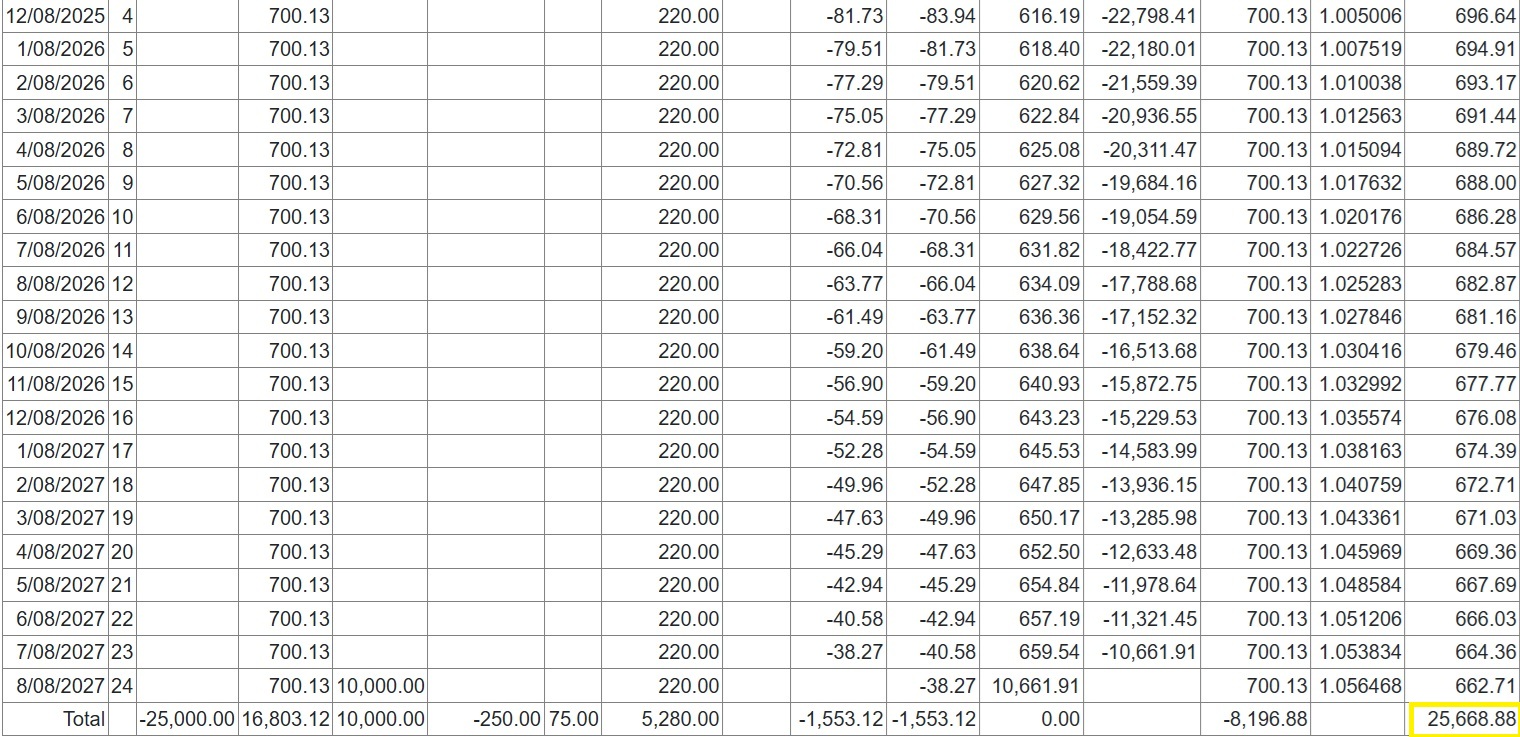

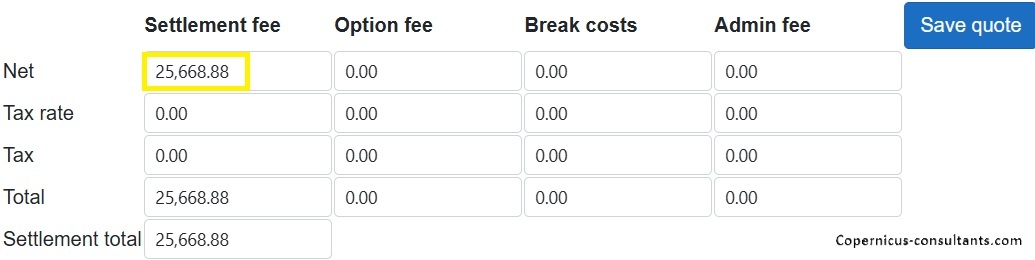

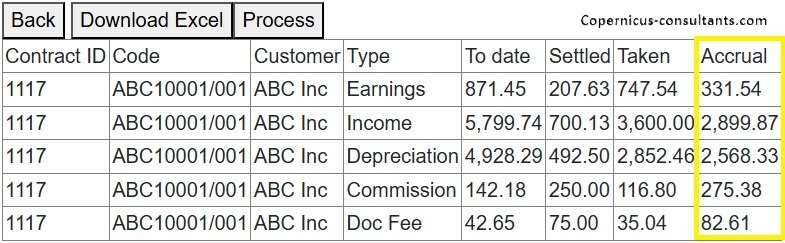

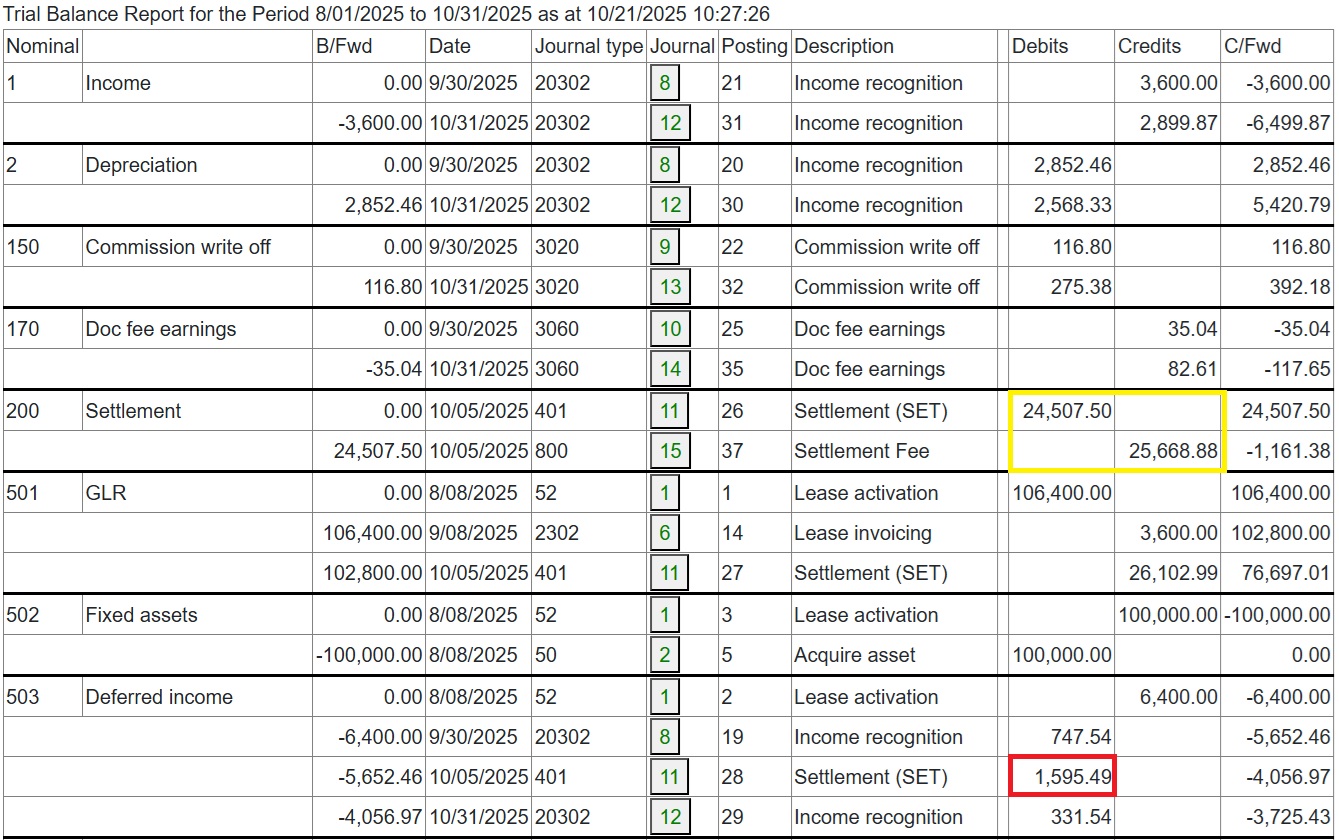

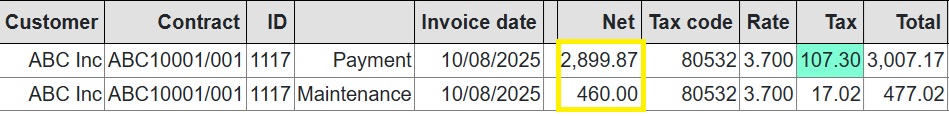

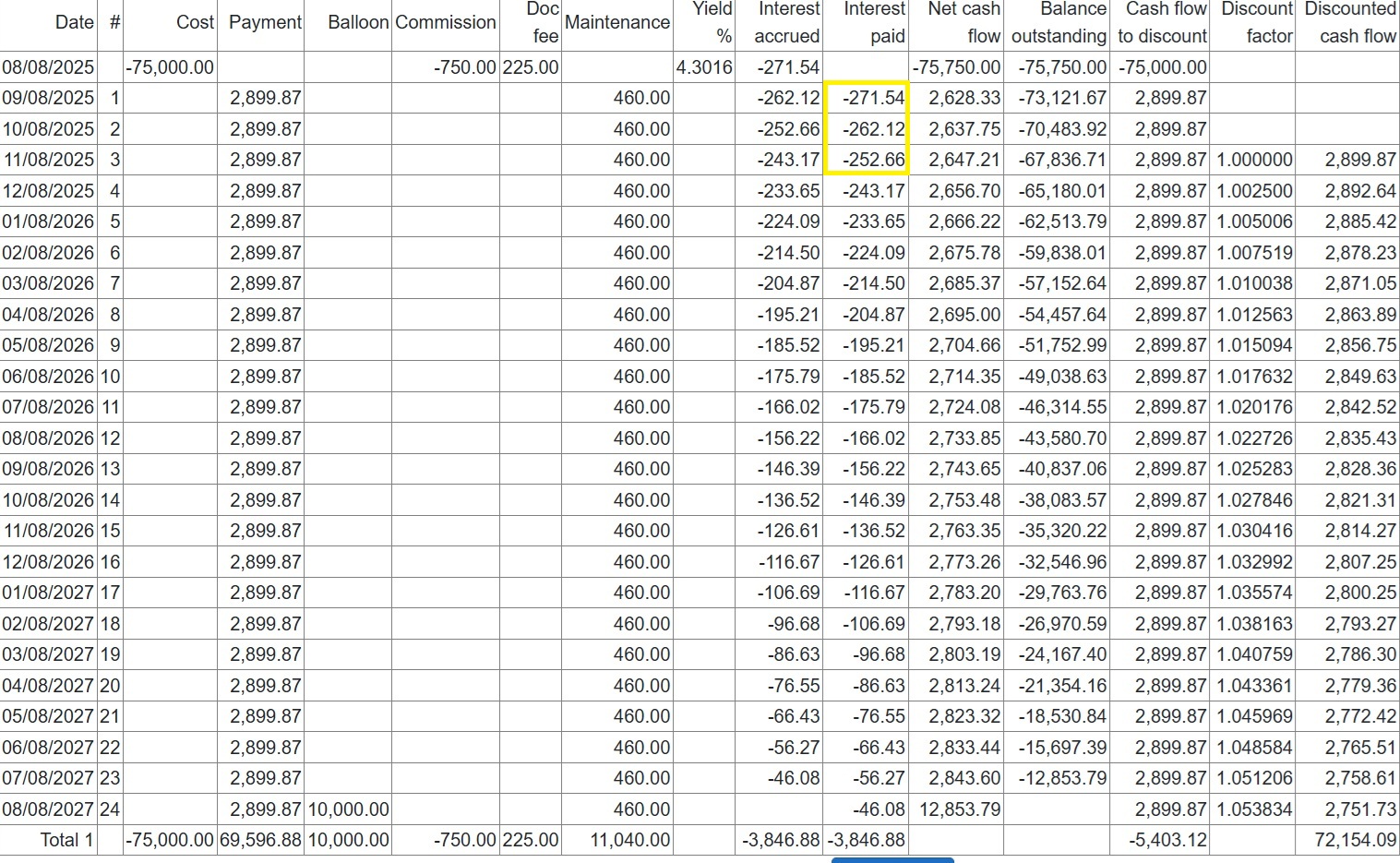

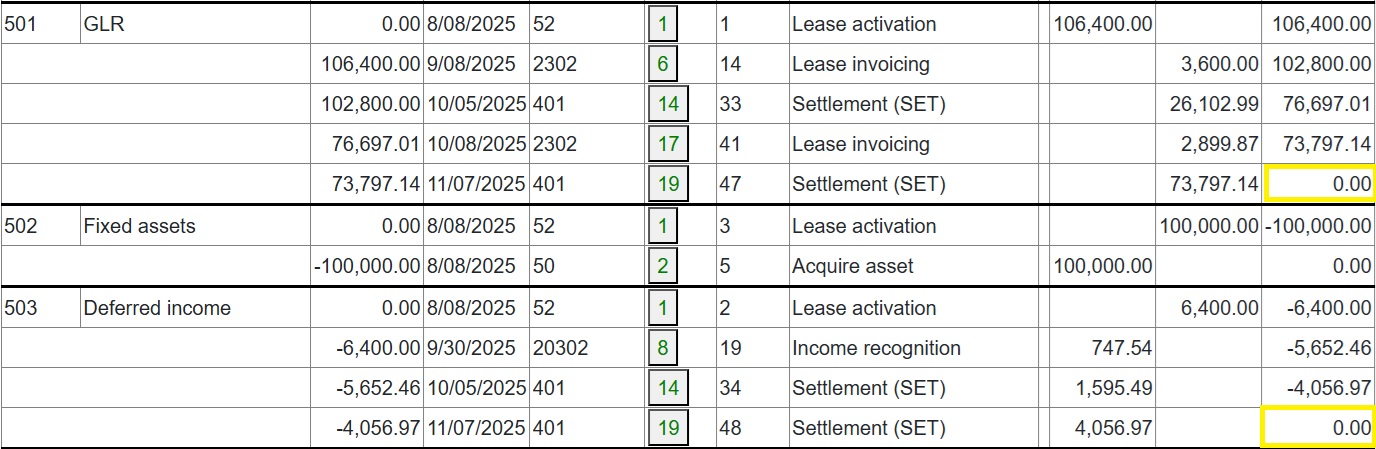

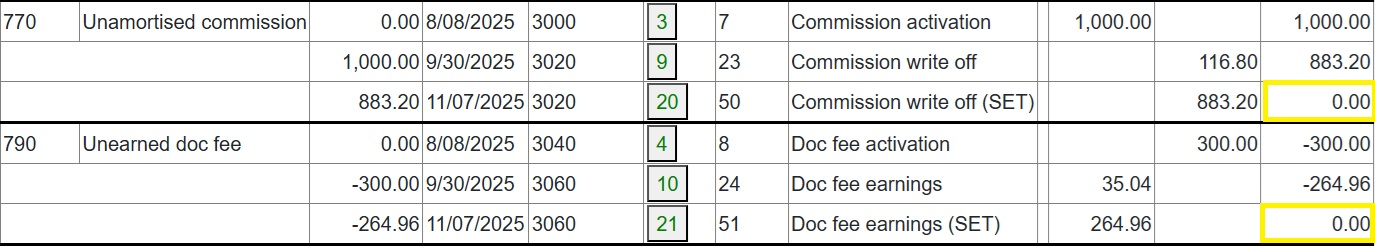

Full and partial settlements (payoffs). Copernicus enables a Quote (with expiry date) and Process (within expiry date) approach to settlements. Settlements can also be reversed using the “Undo” option. Below is a detailed example of a partial settlement. It is based on 4 assets each costing 25,000 with balloons of 5,000, 5,000, 0 and 10,000. As you can see the balloons are not simply a prorata of the total baloon of 20,000 for assets 3 and 4. if we settle one of the first 2 assets then we would expect the payment reduction to be 25% of the total payment of 3,600. This is how the Trial Balance (TB) looks after processing Aug and Sep 2025

Contract novation – existing contract no longer participates in invoicing or income recognition, new contract starts from the novation date with only future payments invoiced to the new customer

Contract split – an existing contract is split into two where, for example, a new customer wants to take over part of an existing contract

Full and partial sale of receivables and securitisation

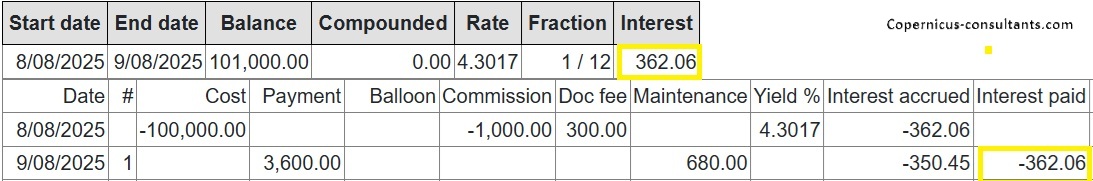

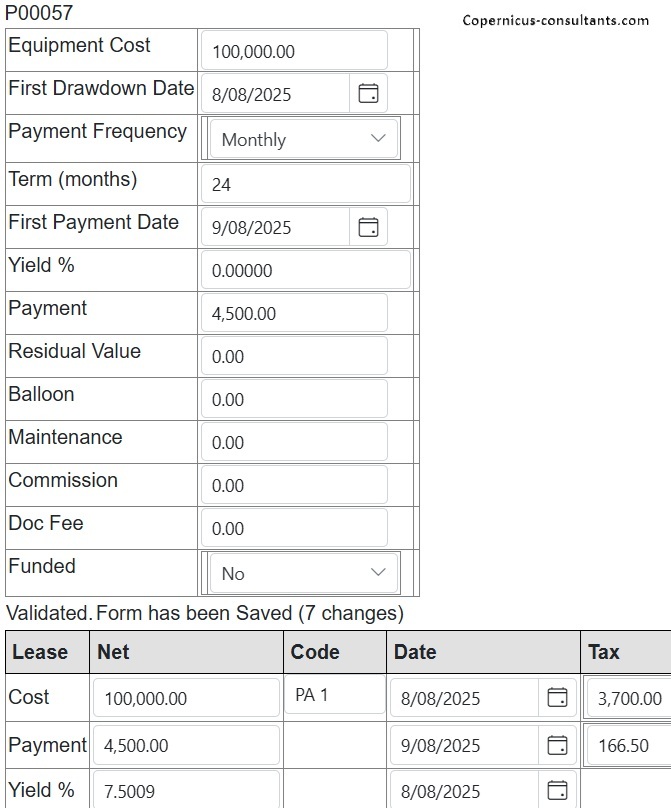

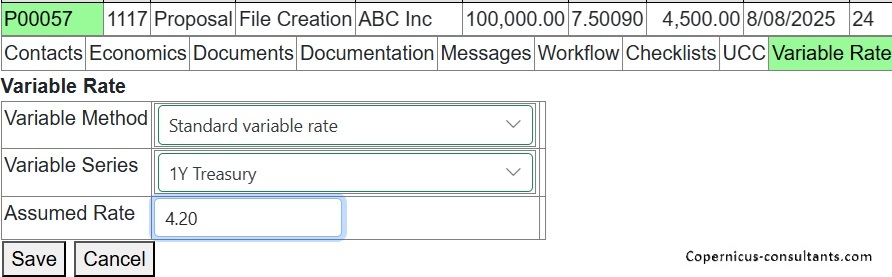

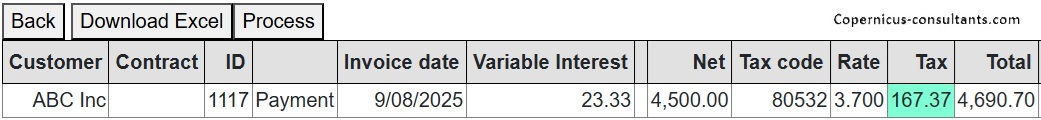

Variable rate adjustments are optional with a range of calculation options and an unlimited number of interest rate series. For example, interest rates may be retrieved automatically on payment dates (rollovers) or every 30, 60 or 90 days with optional business day and end of month adjustments. In the following example we will use a cost of 100,000 and 24 payments in arrears of 4,500 which gives rise to a Yield of 7.5009%.

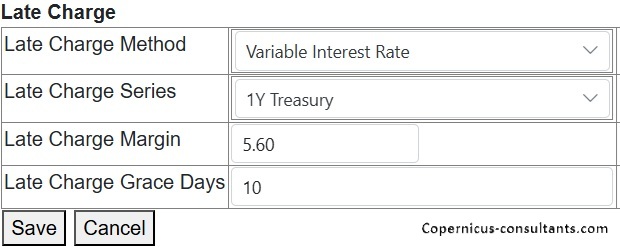

Late payment charges based on either a fixed charge or a fixed or variable rate of interest on the amount outstanding. Here is an example of the late charge input screen

Groups of contracts may be block funded. Alternatively individual contracts may be funded and the funder remitted as payments are collected from the customer (“back to back”). Copernicus also has extensive block funding facilities - use the Contact form to get more details

Regular tasks may be scheduled to automate processes

BACS including AUDDIS, ACH, CAIS, SWIFT, Faster payments, Avalara, Vertex and other sales tax rate providers (see Administration), Postcode and ZIP code lookup, AFD bank finder, Companies House, PTMS, HPI

(Sage, Oracle, Sun and so on) export journals to an external GL. Mapping from Copernicus's accounts to client GL is user-defined

Interfaces to a wide range of Credit Reference Agencies (CRA) are available. Additional interfaes are easily built

DocuSign, eSignature and so on. Additional interfaes are easily built

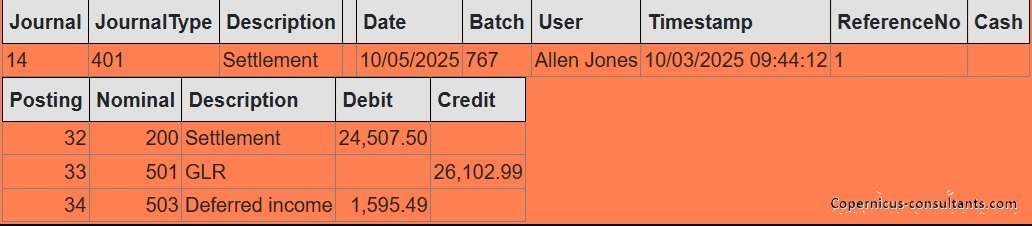

Copernicus has a full double entry bookkeeping system with all financial transactions. This provides the control at the heart of Copernicus using batches and journals based on fixed journal types. The accounting entries are generated using Copernicus’s inbuilt pricing engine which is at the core of all calculations in Copernicus from pricing, income recognition, settlements or variable rate adjustments

Accounting is at contract and asset level and may be consolidated to product, branch, division or company. Reports are also available by contact (customer, supplier, funder etc)

Daily or monthly income recognition using actuarial, straight line or Rule of 78 income apportionment methods

Period closure (usually month end) to ensure journals cannot be posted to earlier periods which have been closed. Note that Copernicus does not have a day end process. All updates are done in real time enabling a 24 x 7 operation

VAT and Sales Tax returns including Make Tax Digital (UK)

Annual or whole life VAT statements

Make and write back bad debt provisions – can be automated

Import bank statement into Copernicus and have an automated reconciliation and permanent record of links to cash receipts and payments journals

Standard and User-Defined reports

User-defined reports may be created by non-technical users using drag and drop

Reports may be generated to screen or exported to PDF, Excel or Word thus facilitating emailing of reports and invoices

There are a large number of standard reports as detailed below

Every financial transaction in Copernicus is recorded in journals within batches, and this report allows the user to view the content of each batch

This report lists accounting journals by Journal Group (process) within a selected date range

This report gives the option of viewing a summary trial balance for contracts, financial products, divisions or companies for any period requested

Provides a report showing individual accounting transactions by nominal account within a date range

This report allows you to select the transactions for any nominal account in the system within a date range for one or more contracts, financial products, divisions or companies

Produces a detailed analysis of the current arrears position by contract

This report shows all contracts that are in credit at a specific date

This report shows all the unallocated cash for each customer/contract in the system

Any unallocated credit notes show in this report

Produces a report showing nominal account balances for contracts, financial products, divisions or companies

Provides further detail on the Balances report

Copernicus enables the projection of payments and other cash flow items together with accounting profiles such as earnings and net book value for current business, pipeline business (proposals) and also budgeted items (projected volumes of business as user specified volumes, rates and terms

This report shows a high level of detail on the user activity within the system, e.g. a contract being updated, an asset being updated, etc. who did it and when

This report displays a summary of the number of contracts within the portfolio by status

This report produces a list of Contracts that have been Activated within a date range. This can be reported by equipment type

A list of contracts settled and their settlement values within a selected date range

Allows the user to select and run the available User Defined Reports. There are many reports available here as standard and as many as required may be added

Provides a list of contracts reaching their end of term in a selected date range

This report shows the NBV of each contract, the valuation of the contract's assets and the difference between these two values

Graph and report on difference between NBV and valuation

Produces a list of creditors in the Portfolio, ie. Suppliers, Brokers, etc. who have not yet been paid

This report shows all the Journal Types in the system and the related nominal accounts that each utilizes

Often used with data conversions to compare the imported contract values with those in Copernicus

This is an additional option to export data required for Basel III reporting

Every data change is logged by user and time stamp and may be reported and filtered

Displays the exposure value and associated values for the selected contact

Report contract income and back-to-back funding expense and profitability

Displays accounts movements by contract for the selected month end

Shows the capital & interest split for each contract in the system

Displays information on Broker performance, ie. Contracts submitted, value, accepted, etc.

Copernicus is totally data driven. There are many user defined options for setting up and amending Company, Division, Branch, Product, Scheme, Interest and Exchange rates, editing documents using the Word like online editor, creating user defined reports and many more. We’ll just mention Security here which should assist with understanding the way users are handled in Copernicus

Create and maintain individual users and their user-specific access rights, for example, whether they can change bank details

Users are assigned to a “UserGroup”. UserGroups are given access to menu items. Where a UserGroup does not have a menu item it is not displayed to the users in that UserGroup

Users are also assigned to a “WorkGroup”. This is used to enable an Action to be directed at a group of Users rather than a single individual. For example, Collections is often a WorkGroup and users in that group share the Actions that are placed on that WorkGroup ie they all have visibility of an Action and can pick it up and deal with it